Option straddle calculator

VIX options and futures. Lets get started today.

:max_bytes(150000):strip_icc()/understandingstraddles22-19b55dd41aee458287dda61e4929428a.png)

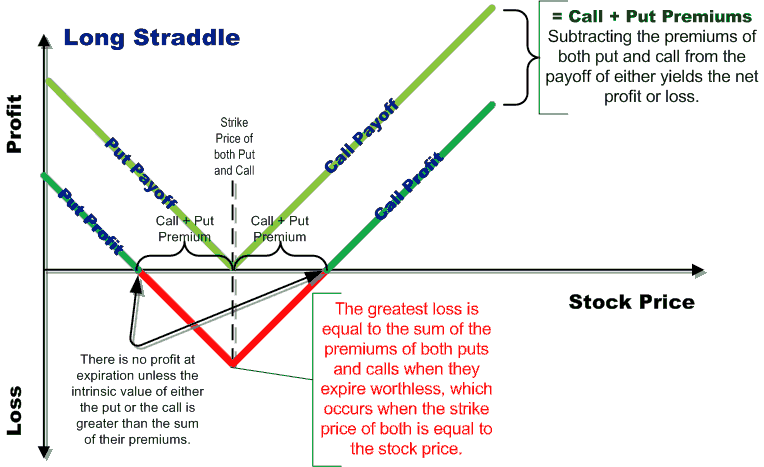

Long Straddle Definition

Estimates for the Greeks of an option ie.

. Packer Specs PDF Packer Inflation Pressure Formula. Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time. So far we have assumed that you are currently opening a new trade using the current option prices.

No more scrolling through lengthy option chains just select a stock expiration. Option Alpha Review Long. Which Should You Use.

Ad Discover how my Weekly Paycheck Method tripled account in 8 mo. See How to Make Money Online. When an option expires you have no longer any right in the contract.

Ad Manage volatility w a tool that directly tracks the vol market. The option calculator uses a mathematical formula called the Black-Scholes options pricing formula also popularly called the Black-Scholes Option Pricing Model. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

However its different from other segments since its a kind of contract that gives. Build option strategies in real-time with our options profit calculator and visualizer. If you bought the option at 288 initial option price in our example your profit from the entire trade would be 400 288 112 per share 112 per contract.

Our tools and algorithms help investors design option strategies. Call Spread Calculator shows projected profit and loss over time. Build Your Future With a Firm that has 85 Years of Investment Experience.

Soil Vapor Extraction SVE Well Heads. You can also see this in the. Underneath the main pricing outputs is a section for calculating the implied volatility for the same call and put option.

Discover the Power of thinkorswim Today. Poor Mans Covered Call calculator addedPMCC Calculator. Create Analyze options strategies view options strategy PL graph online and 100 free.

All the real time data is given to user so that he is not behind anyone. Option Trading is a broader term used in the investment sector just like equity commodity currency etc. Use the Profit Loss Calculator to establish break-even points evaluate how your strategy might change as expiration approaches and analyze.

Option expires Out of the Money. Ad Commissions from USD 015 to 065 per US option contract. Ad Were all about helping you get more from your money.

Strategy We can strategically trade options using option max pain excel in the following ways. Here you enter the market prices for the options. An call options Value at expiry is the amount the underlying stock price exceeds the strike price.

Binomial tree graphical option calculator. Python quantitative trading strategies including VIX Calculator Pattern Recognition Commodity Trading Advisor Monte Carlo Options Straddle Shooting Star. The mathematical derivatives of option value with respect to input parameters can be obtained.

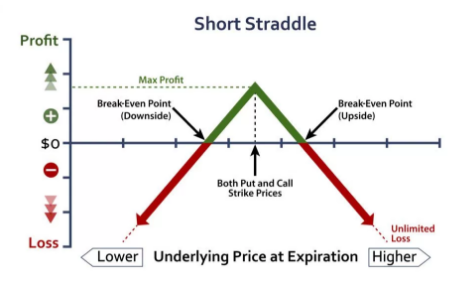

Find the best spreads and short options Our Option. Straddle Calculator shows projected profit and loss over time. As Ratio Trade we can take a strategy by selling three lots of 9900 CE and 9300 PE each.

It is a strategy suited to a volatile market. The Profit at expiry is the value less the premium initially paid for the option. The calculator works in all versions of Excel from Excel 97 to the latest also including Office 365 and Excel for Mac.

Enter the price you expect the stock to move to by a particular date and the Option Finder will suggest the best. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. This is the Excel of the current.

What does the Advanced Options Trading Calculator include. A call spread or vertical spread is generally used is a moderately volatile market and can be configured to be either. The Advanced Options Calculator is composed of several files.

Take the hard work out of finding the right option with our Option Finder. It is also commonly referred to as a buy. Covered Call Calculator The covered call involves writing a call option contract while holding an equivalent number of shares of the underlying stock.

See Monte Carlo option model. Access Our Full Suite of Innovative Award-Winning Trading Platforms Built for Traders. When the strike price of an option is higher than the current.

Either the original Cox Ross Rubinstein binomial tree. If you already bought an option and want to see what the profit and loss. The default version is a standard macro-enabled xlsm file but there is also.

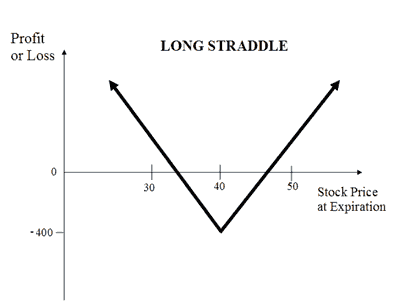

Check your strategy with Ally Invest tools. A straddle involves buying a call and put of the same strike price. Our tools and algorithms help investors design option strategies.

Get your Free Copy here. Lets you calculate option prices and view the binomial tree structure used in the calculation. 10 Tips For Option Trading Success Everything You Need To Know About Options Bid Ask Spread IV Rank vs IV Percentile.

The maximum risk is. Use the Profit Loss Calculator to establish break-even points evaluate how your strategy might change as expiration approaches and analyze. Check your strategy with Ally Invest tools.

Ad Commissions from USD 015 to 065 per US option contract. See how this trading course helps small investors earns Extra Income. Cash Secured Put calculator addedCSP Calculator.

The P L Chart Robinhood

Long Straddle Option Strategy Guide Example

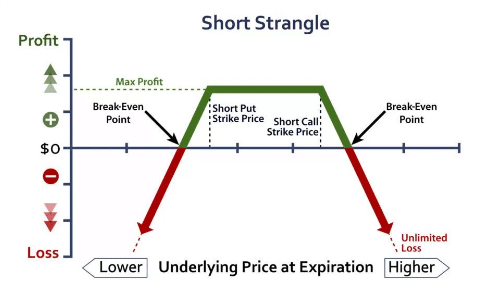

Short Strangle Option Strategy

Short Call Ladder Explained Online Option Trading Guide

Long Straddle Buy Straddle Option Strategy Explained

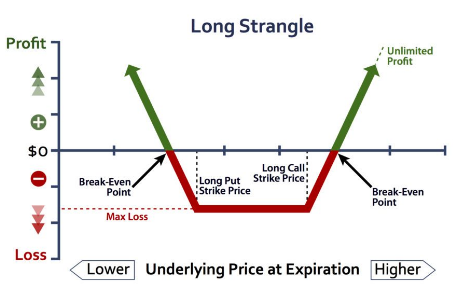

Long Strangle How To Use Long Strangle Guide Examples Risks

Long Straddle Option Strategy The Options Playbook

Short Straddle Option Strategy Guide Example

Pin On Atomic Clock

Long Straddle Volatile Options Trading Strategy Suitable For Beginners

/understandingstraddles22-19b55dd41aee458287dda61e4929428a.png)

Long Straddle Definition

Options Strategy Payoff Calculator Excel Sheet

Short Straddle Option Strategy Guide Example

Long Straddle And Long Strangle Option Strategy Which Is Better Long Straddle Or Long Strangle In 2022 Option Strategies Strategies Good Things

Short Straddle Options Strategy Risks Profits Examples

:max_bytes(150000):strip_icc()/dotdash_INV_final_Get_A_Strong_Hold_On_Profit_With_Strangles_Jan_2021-01-a99fea66493449eea01e450feb7475e2.jpg)

Get A Strong Hold On Profit With Strangles

Pin On Finance